Hey CWBS!

As we go into our last few weeks before a new (and unprecedented) semester kicks off, I hope you’re all finding ways to stay optimistic about the upcoming year. CWBS is so excited to be offering digital ways to stay engaged, from our upcoming Know Your Worth 101: Financial Literacy Series (our first session is tonight!), to investing through the Public app (use our link for $20 of credit on us!), to, of course, sending out The Scope every week. This week, we’ll be highlighting the Fintech industry, Mabel A. Nuñez’s journey to creating a hugely successful female-focused financial education platform, and amidst it all, what’s going on with TikTok. Happy reading!

- Sophia Naqvi, Membership Engagement Chair of CWBS 2020-2021

PUBLIC: Invest in good company.

Want to give Public a try? Download the free app and start with $20 worth of stock on us.

TIK-TOK, TIME’S UP: After Trump signed a controversial executive order banning popular Chinese apps TikTok and WeChat from the US in 45 days, major American companies, such as Twitter and Microsoft, have held preliminary talks about acquiring the popular entertainment app. Microsoft recently announced that it is in talks to not only acquire TikTok’s operations in the United States, but is now trying to reach a deal to buy the rights to TikTok’s global operations by September 15th. Learn more.

UPHEAVAL IN BEIRUT: After a bomb blast at a busy port devastated the Lebanese capital of Beirut, Lebanese citizens are demanding an upheaval of their central government. Key ministers have resigned, including the Information Minister and several members of parliament. The Beirut bomb blast comes amid citizens’ widespread struggle from a catastrophic economic collapse – could this be the catalyst to spark tangible economic and political change in the country? Learn more.

IT’S AUTOMATIC, SYSTEMATIC, HYDRAULIC…AND ASYMPTOMATIC?: New research suggests that forty percent of infected coronavirus patients may be completely asymptomatic, with rates of up to 94.6% asymptomatic carriers of those infected at a grocery store in Arkansas. Could they be the key to ending the pandemic? Learn more.

MABEL A NUÑEZ of GIRL$ ON THE MONEY

“I had to create a space where I could show, using myself as an example, that anyone can learn to invest and anyone can do it successfully.” - Mabel A Nuñez

Mabel is the founder and Chief Education Officer of Girl$ on The Money - a stock market investing education company targeted to women, minorities, and individuals that are underrepresented in the world of investing. She is passionate about investing education, helping women feel more confident around money topics, and empowering them to take action and control of their finances.

Mabel is also the best selling author of two investing books "Stock Market Investing Mini Lessons for Beginners" and Stock Analysis 101. She teaches highly rated courses around the topics of personal finance and investing. Through all of her resources, content, and social media platforms - she shares what she has learned (and continues to learn) thanks to 10+ years of investing experience and 2 finance degrees. You can follow Mabel on Instagram @Girlsonthemoney.

What inspired you to start Girl$ On The Money?

In my senior year of college, I took my first class on investing; It was a topic that I had never heard of before. I took that one class and became interested in the idea that anybody (with some income) could buy pieces of amazing corporations and grow wealth through those investments.

I decided to educate myself on investing, but then I realized that most of my female friends didn't want to talk about the topic, felt that investing was too hard, or felt that the topic was not for them. I realized there was a problem in regards to women not getting into investing, so Girl$ On The Money started with a mission of teaching women how to invest, how to get them excited about investing, and teaching them that investing isn’t difficult. That’s how Girl$ On The Money was born.

What are some standard investing practices or tips that you think all women should know?

There are certain things that you should have in place before you start investing, so, for example, an emergency fund is very standard, and if you have consumer credit, work on getting rid of that as well.

Then, start an investment fund – so, essentially just save money just for investing purposes; you can do that by opening an online brokerage account (an investment account). Then, think of companies that you like, where you’re a consumer, and where you understand the business. Always go with companies that you understand, that you know, that you feel good about, that you believe will still be here in the next five, ten years – that's key to being a good investor.

Also, look at your investments as they fluctuate – how do you feel about those fluctuations? Observing such fluctuations helps you get used to the industry; everybody should start on their [investing] journey slow and steady, but always with companies and investments that they understand.

Describe the process of writing and publishing your two best-seller investing and finance books.

It wasn't as difficult as people might think, because [investing] is a subject that I really love and am obsessed with. I write newsletters every week, so my first book was essentially those newsletters put together. I put them all together and hired an editor to make the book look presentable and worthy of being published; so that was a simpler method for my first book. For my second book, I actually had to sit down and make an effort to write it because I didn't have information on how to research a stock anywhere else.

What challenges did you face in starting Girl$ On The Money, particularly as a woman of color?

The world of investing and finance is mainly men. I mean, this “all-male, Caucasian-male, Wolf of Wall Street” image is the mentality that a lot of people have about the world of investing. So I had to create a space where I could show, using myself as an example, that anybody can learn to invest and anyone can do it successfully. Does it matter where you're from, what you look like, what your background is? No – it’s a skill, so you can learn it just like any other skill. You don't need to have a background in finance to be a successful investor. None of that. You don’t need a financial advisor or bank to help you learn to invest, and I paved a way for myself by showing that I was knowledgeable about the topic, and that investing something that everybody can do.

If someone logs on to girlsonthemoney.com for the first time, where should they start?

I’d say start with the blog section; scroll back to the very beginning, which is where I start talking about the stock market because as the time goes by, I talk about different topics. Go back a few years ago and start there.

What's a book you've read recently that you would recommend to the CWBS community?

The Gone Fishin’ Portfolio by Alexander Green.

What advice would you give to other young women seeking to create similar platforms that provide accessible, female-focused financial literacy?

If you feel that you're somebody who knows their stuff, is confident, has some experience, and is a credible person, showing what you know on social media platforms to make what you know easy to understand [is a start].

Additionally, you have to be consistent – you can’t post today, disappear for two months, and come back. People want to see consistency, and they want to see that you’re an expert in your field.

Lastly, use yourself as an example. Use your stories to talk about different things, because people connect to that.

Who is a woman leader that you look up to?

Julie Stav; she's one of the very few women who is Hispanic in the investing world, and I’ve been following her for over a decade. She inspired my journey through the years by making [investing] simple, encouraging more women to invest, and showing that anybody can learn how to invest. I look up to her tremendously; every time somebody asks me about a woman that I look up to, it’s her.

Read Mabel’s full interview on The Scope Website.

Internships

Banking/Finance

Consulting

Tech

Startups

Venture Capital

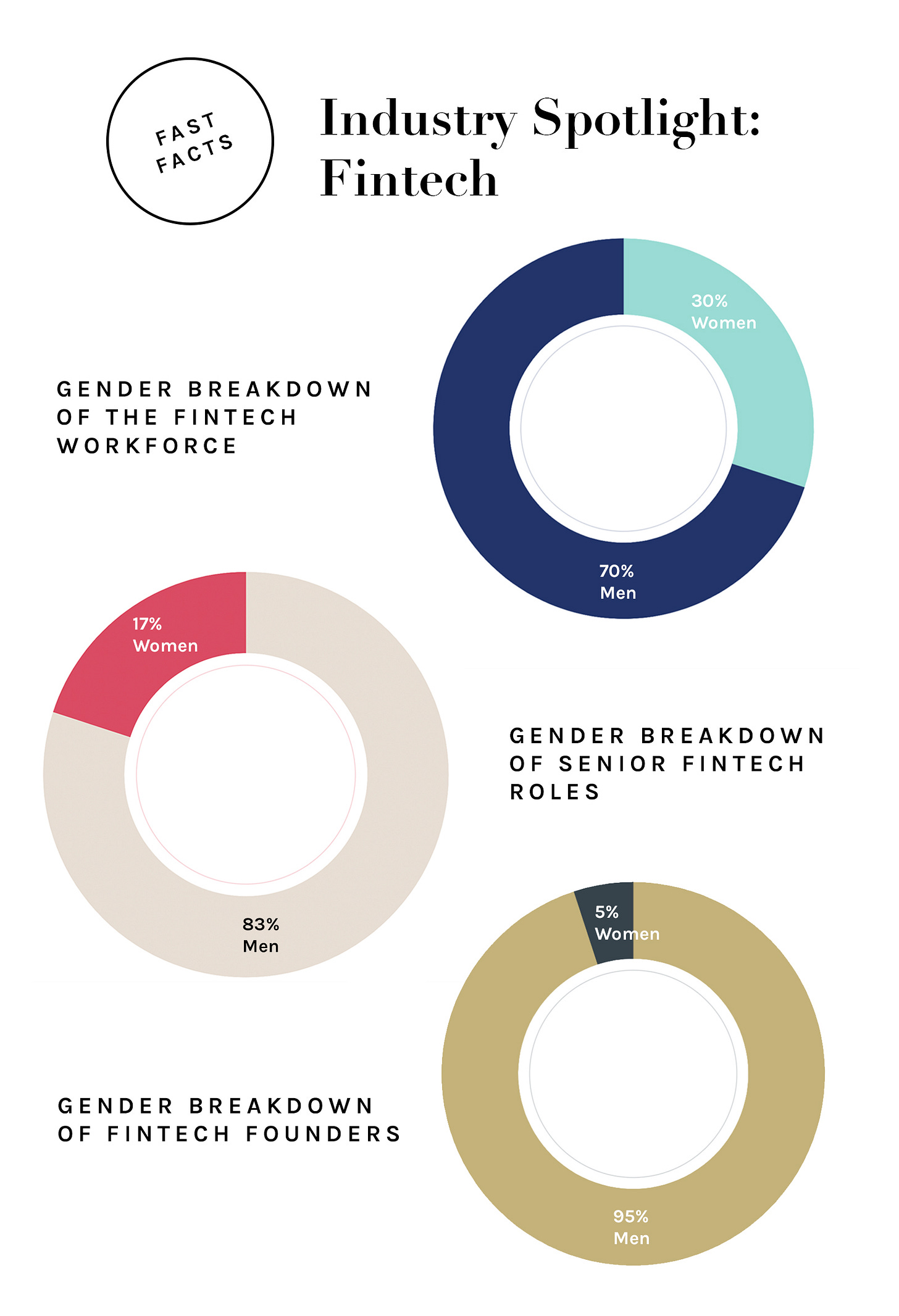

FINTECH

What is Fintech? Financial Technology (Fintech) describes innovative technologies that aim to improve and/or automate the delivery and use of financial services.

Who does Fintech serve? Fintech serves companies and consumers in better managing their finances by providing advanced algorithms through computers and smartphones.

Major Firms: Ant Financial, Adyen, Qudian, Xero, SoFi, Lufax, Avant, and ZhongAn are amongst the world’s biggest Fintech firms.

Definitions and information from Investopedia.

Breaking Through: The Complete Guide to Getting a Job in Investment Banking | Consulting | Accounting (sherjan.teachable.com) - Use code below to get $100 OFF

If you're interested in breaking into the top investment banks such as Goldman Sachs or Morgan Stanley, or leading management consulting and accounting firms such as McKinsey & Co. and PwC, then this course is the complete guide to getting your dream job. Learn more and enroll at sherjan.teachable.com and use coupon code COLUMBIA20 at checkout to get $100 OFF. The course is taught by Sherjan Husainie (sherjan.com), a former Vice President in Investment Banking at Morgan Stanley and prior to that an investor at CapitalG, Google's late-stage investment arm.

Know Your Worth 101: Financial Literacy Series (CWBS)

This financial literacy series is comprised of three events tailored for total beginners. Our Debt & Budgeting kick-off panel lays the foundation for a basic understanding of personal finance and debt management. The second panel, Stock 101, breaks down the hard-to-understand terms of the stock market for those with no previous knowledge. It will also provide useful tips for a successful stock investment strategy. Our third event is on Impact Investing. It dives into how one can create a successful stock portfolio using their values to guide their dollar.

Debt & Budgeting • Aug 10th, 8pm-9pm EDT

https://columbiauniversity.zoom.us/j/98087318467?pwd=OUkzUjZFQ1d4dkRGckNPWnZzTXMyQT09

Stock 101 • Aug 17th, 8pm-9pm EDT

https://columbiauniversity.zoom.us/j/91777629390?pwd=eGJMb1RxWld3YXBnR25JZG5adnlpZz09

Impact Investing • Aug. 24th, 8pm-9pm EDT

https://columbiauniversity.zoom.us/j/94849293457?pwd=d0dmczA0UUxZZzg4amY1UXVTM1N0dz09

Learn more here.

HILMA: Upgrade your medicine cabinet. Natural remedies, formulated without doctors. Use code COLUMBIA for 10% off

RINGCONCIERGE:

For 15% off fine jewelry (excludes bridal, diamond studs, rolex, and gift cards), use code CWBS15 (ends 9/1/20).

Money Girls: It’s time to run your own money.

MoneyGirls’ goal is to empower all women to maximize their independence, influence, and leadership by giving them the tools and resources necessary to take control of their financial lives. MoneyGirls aims to carry out this mission through the Monday MoneyDrop, a once-a-week newsletter, the MoneyBag, and the MoneyGirls Strategist Network. Later this summer, the MoneyGirls app will launch, bringing the world of accessible financial literacy right to your fingertips through innovative tech. Get involved here.